The Crypt0l0g1st publication #001

The Crypt0l0g1st is a curated weekly newsletter regarding Blockchain, web3, defi, gamefi, crypto investments and other.

The Crypt0l0g1st is here to stay! Starts today a weekly newsletter to inform you about the main facts of Crypto, BlockchainTechnology & Other . The Crypt0l0g1st is 100% independent and does not take any money in the form of sponsorship from anyone, in this way we believe we can make unbiased communication on all events and ensure maximum information. Our commitment is to become the complete and engaging news source every week. Are you ready to go ? Let's go !

THE TOP 25 COUNTRIES IN THE WORLD BY PROFITS MADE IN BTC

This week, invezz.com released a study examining the most profitable bitcoin traders by country, using statistics from multiple datasets.

Study author Dan Ashmore explained that one dataset came from Chainalysis. It shows the top 25 countries in the world by profits made in bitcoin (BTC).

The top country on the list in terms of percentage of the population investing in bitcoin was Ukraine, where 12.7% of the population invested in BTC. In second place is Russia with an indicator of 11.9%, in third place is the United States with 8.3%. Then, in 4th place is India, with 7.3%.

But in quantitative terms, India is the undisputed world champion. India's 7.3% population of 1.38 billion is over 100 million in total. While in the United States, the population is 329 million and only 27 million have become bitcoin investors.

As far as the most successful traders are concerned, the palm belongs to Switzerland. Each trader in this country received a realized profit of $1268 per person. This is the average in the room. Of course, most traders received nothing or suffered losses. But on average, the Swiss are the coolest traders in the world.

The Czechs are not far behind them with an indicator of $1259 per person, despite the fact that in the Czech Republic only 2.2% of the population has invested in bitcoin. The Japanese and Spanish also trade well. Everyone else is much worse.

Ukrainian investors managed to make an average of $72 per person. Each Russian trader managed to make a profit from selling bitcoin in the amount of only $35 per person. In India, the average return per investor was $2.

MAX TVL IN DEFI

Total cumulative blocked value (#tvl ) across all #DeFi protocols has increased by 20.7% over the past 30 days, largely due to #terra . Total #defi #tvl has increased by over 218% in just one year.

Question: how much will things change with the more comprehensive launch of #ETH 2.0 ?

https://cryptorank.io/

MONERO

eemuru provided a fantastic post on the official Monero website titled This Year in Monero - 2022 in recognition of Monero’s continued growth. Highlights from the post include:

On-chain transaction usage grew 154% year-on-year.

Blockchain size grew 144% faster year-on-year.

Inflation decreased 34% and is steadily approaching the tail emission of 0.6XMR per block.

The average transaction fee dropped 48%

Network hashrate increased 53%

Twitter followers of @monero and subscribers to r/monero on Reddit both increased by over 20%.

THE TOTAL VOLUME OF STABLECOINS

Total stablecoin supply has reached $190 billion.

According to CryptoRank.io, total stablecoin supply has surpassed $185 billion and set the new ATH at $190 billion in April 2022, a growth since the beginning of the year of just over 10%.

Stablecoins play an incredibly valuable role within crypto as they allow holders to keep cash in the ecosystem while leveraging the financial superpowers of blockchains and DeFi. The sector also represents one of the fastest-growing verticals in the industry, as the total market cap of stablecoins has increased more than 115% in the past year and 2950% since January 2020.

Grayscale makes fresh push for SEC approval to become bitcoin ETF

According to what is stated here, Grayscale has made a fresh attempt to win approval from the US securities watchdog to turn the world’s largest crypto investment vehicle into a fund that trades on major Wall Street exchanges.

Several rivals have already been rebuked in their attempts to open similar funds and Grayscale’s gambit represents one of the crypto industry’s last hopes of launching such a product in the near future. Only three other similar crypto ETFs are in the queue for approval.

The SEC has pushed back against so-called spot crypto ETFs due to concerns that the coins trade on unregulated platforms where surveillance is difficult and manipulation a consistent problem. It has approved ETFs holding crypto futures, but those products trade on platforms that are overseen by US financial regulators.

TWITTER INTRODUCE VIRTUAL CURRENCY AS PROOF TO PAY REVENUE

The IT company 'Stripe', which provides financial infrastructure, has announced the function to receive profits on Twitter with cryptocurrencies (virtual currency).

First, we started to test the service by limiting the users and first we supported the stablecoin 'USDC'. Considering the fees, processing speed and wallet compatibility, it supports the Ethereum (ETH) network scaling solution " Polygon (MATIC) ". In the future, it plans to increase the number of corresponding brands.

NFT 'RTFKT' LAUNCHES TRAINERS IN PARTNERSHIP WITH NIKE

RTFKT", which produces NFT trainers on the Metaverse (virtual space), has released shoes in collaboration with its parent company, the leading sports brand "Nike". It is only available to those who have purchased "RTFKT-MNLTH" on OpenSea, the largest NFT electronic marketplace.

Link: https://www.outpump.com/ecco-il-primo-nft-realizzato-da-nike-e-rtfkt-studios/

Justin Sun to launch algorithmic stablecoin USDD on Tron, will use $10 billion of crypto as collateral

Justin Sun announced plans to launch USDD, an algo stablecoin built on the Tron network.

The stablecoin won't operate like traditional ones do, such as Tether (USDT) and Circle’s USD Coin (USDC), which keep dollars (and other assets) in bank accounts as backing. Instead USDD will be an algorithmic stablecoin like TerraUSD (UST) and Frax Finance (FRAX).

The stablecoin will have a similar system to these algorithmic stablecoins in order to keep its peg to the US dollar. As Sun explained, “When USDD's price is lower than 1 USD, users and arbitrageurs can send 1 USDD to the system and receive 1 USD worth of TRX. When USDD's price is higher than 1 USD, users and arbitrageurs can send 1 USD worth of TRX to the decentralized system and receive 1 USDD.”

DEX giant Uniswap imitates access to wallets involved in illegal activities

Uniswap Labs, the developer of the leading DEX (decentralised exchange) Uniswap, has announced a partnership with blockchain analysis company TRM Labs. It has been revealed that it is proceeding with access control (blocking) of cryptocurrency (virtual currency) wallets that have been found to be involved in illegal activities.

Uniswap is one of the first major decentralised finance apps running on Ethereum (ETH) . By providing tokens to the liquidity pool, peer-to-peer (P2P) transactions can be executed. The cumulative transaction volume has reached about $1 trillion.

According to the announcement, TRM Lab has identified wallets involved in sanctions, terrorist financing, hacking and theft, ransomware, etc., and Uniswap Labs is working to block them from the front end. the total number of blocked portfolios has not been announced.

https://www.theblockcrypto.com/post/143036/uniswap-labs-now-blocks-crypto-wallets-frontend

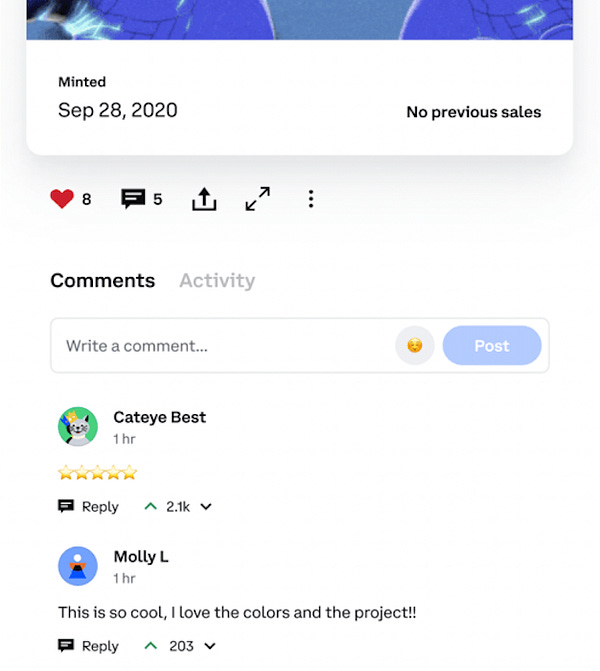

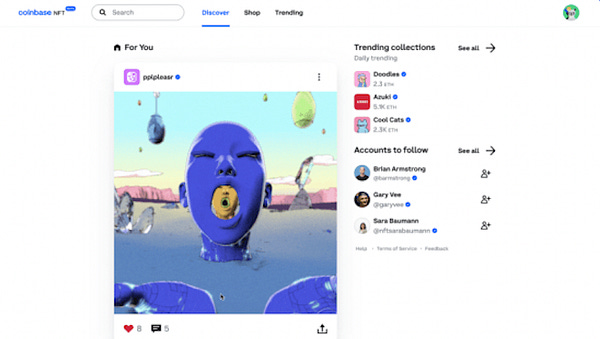

COINBASE NFT News & Platforms

Coinbase NFT, which leverages Manifold’s Royalty Registry, launched in beta this week:

A READ FOR YOU 📚

Non-Fungible Token (NFT): Overview, Evaluation, Opportunities and Challenges

NFT: property limits, practical considerations

Blockchain networks: Data structures of bitcoin, monero, zcash, ethereum, ripple, and iota